Many growing businesses considering accounts receivable funding have concerns about how a factoring company will affect their customer relationships. Will they think my business is struggling? Will they be hunted down by my financier for late payment? Will they be uncomfortable not paying my business directly? We’ve heard all of these questions, but we find that our clients actually see healthier relationships with their customers while they use our factoring services.

Credit Check

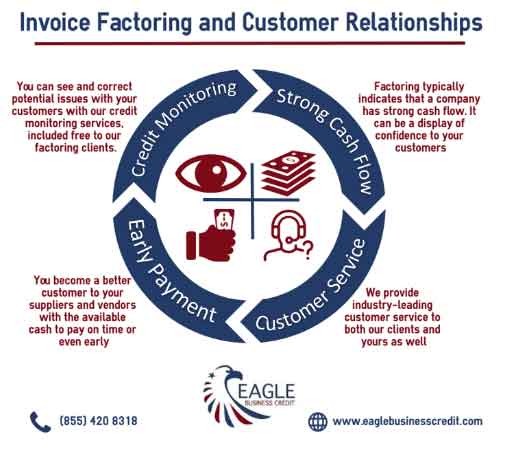

In addition to advancing payment on open invoices, we offer free credit monitoring on your customers. Knowing that your clients may have difficulty paying for your goods or services means having the foresight and time to implement a payment plan that works to both parties’ benefits. No harassing collections calls or severing of a business relationship is required.

Indication of Strong Cash Flow

Partnering with a factoring company typically indicates that a company has strong cash flow. With 82% of failed businesses citing cash flow problems, having available working capital is the key to profitability. Business growth comes with cash flow constraints, so many growing businesses utilize factoring services to meet their cash flow needs and keep growing.

Customer Service

Eagle Business Credit guarantees industry-leading customer service. This extends not only to our own clients but to their clients as well. Throughout the collections process, we maintain professionalism, courtesy, and friendliness. We do not chase your debtors down or make unreasonable demands. It is in both our and your best interests that we offer the best customer service to your clients.

Pay Your Vendors and Suppliers

Not only does factoring benefit your customers, but you will be a better customer as well. Fast payment on your outstanding receivables means having the working capital available to pay your vendors and suppliers on time or early. You may even be able to negotiate a discount with your suppliers for early payment.

Factoring Companies Affecting Customer Relationships

An important mission at Eagle Business Credit is that we do not lock our clients into lengthy contracts. Our clients choose to stay factoring with our invoice factoring services because of our excellent customer service. We emphasize personal relationships and see our financing services as an extension of the client’s business. Rather than operating as a bottom-line focused entity, we prefer to operate as a sort of partnership with our clients. When your business grows, our business grows. Similar goals make our factoring services effective, growth-enabling, and beneficial to your customer relationships.

Eagle Business Credit

Our working capital funding solutions do not create debt on your balance sheet. The money is yours, we just expedite the process. Accounts receivable financing helps your business grow, simplifies the business process, and alleviates some stress that comes with being an entrepreneur. See how our working capital funding solutions can strengthen your customer relationships.