When small businesses are looking for cash, one overlooked option is invoice financing. This is a cash flow tool that leverages your invoices as collateral. Essentially, you turn your open receivables into immediate capital that you can use for supplies, payroll, or other business costs to support your growth. Cash flow will determine whether your business thrives or fails, and invoice financing is a debt-free method of improving your small business’ cash flow.

What is Invoice Financing?

First, invoice financing varies depending on what lender you partner with. At Eagle, we offer invoice financing that looks like a debt-free line of credit. The way it works is your business makes a sale to another business. You sell your invoice to us at a discount of around 2-4%. We advance funds to your business immediately, and you then have the cash on hand to make and fulfill another sale. After the agreed upon credit terms with your customer expire, we collect the invoice amount from then. You don’t even have to worry about the collections process when using invoice financing.

Invoice Factoring Process:

- You fulfill a service or order to a customer

- We immediately pay your business 85-95% of the invoice amount

- We wait 30 to 60 days (depending on your payment terms) for your customer to pay

- We collect from your customer

- We release the remaining funds (less a fee of 2-4%) to your business

Who Uses Invoice Financing?

Typically businesses that sell to other businesses on credit terms are the perfect candidates for invoice financing. That is because there will be a cash flow gap in their business model where invoice financing can step in and provide strong cash flow. The receivable or invoice will be the collateral, and there is no debt or repayment involved. Once an invoice finance company like Eagle Business Credit pays your company, the money is yours. Most frequently, invoice financing is described as a revolving line of credit that is tied to your receivables. The more you sell, the more funding you have. The financing grows with the needs of your business.

Why Use Invoice Financing to Fund Your Small Business?

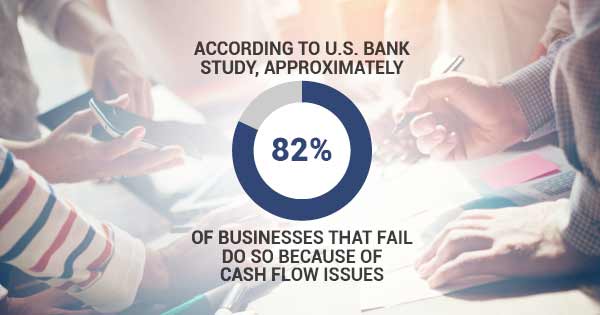

The number one reason behind using invoice financing to support your business is for healthy cash flow. Growing or new businesses will have cash flow problems, and when 82% of failed businesses cite cash flow as a reason, it is important to focus on improving your cash flow. Another reason to use invoice financing is to support your business growth. Invoice financing can be used to fund your business when you have already taken out a loan and spent that money. The amount of funding available to your business will grow with the volume of your sales, so there is no need to reapply for more business financing. It makes a lot of sense if a small business needs fast, flexible, and low-cost funding. Many other methods of business funding can get expensive quickly, unless you have the time to wait for application and approval or near perfect personal and business credit scores.

Get Started

Today

Curious about how invoice financing can support your business? Get a free quote today!