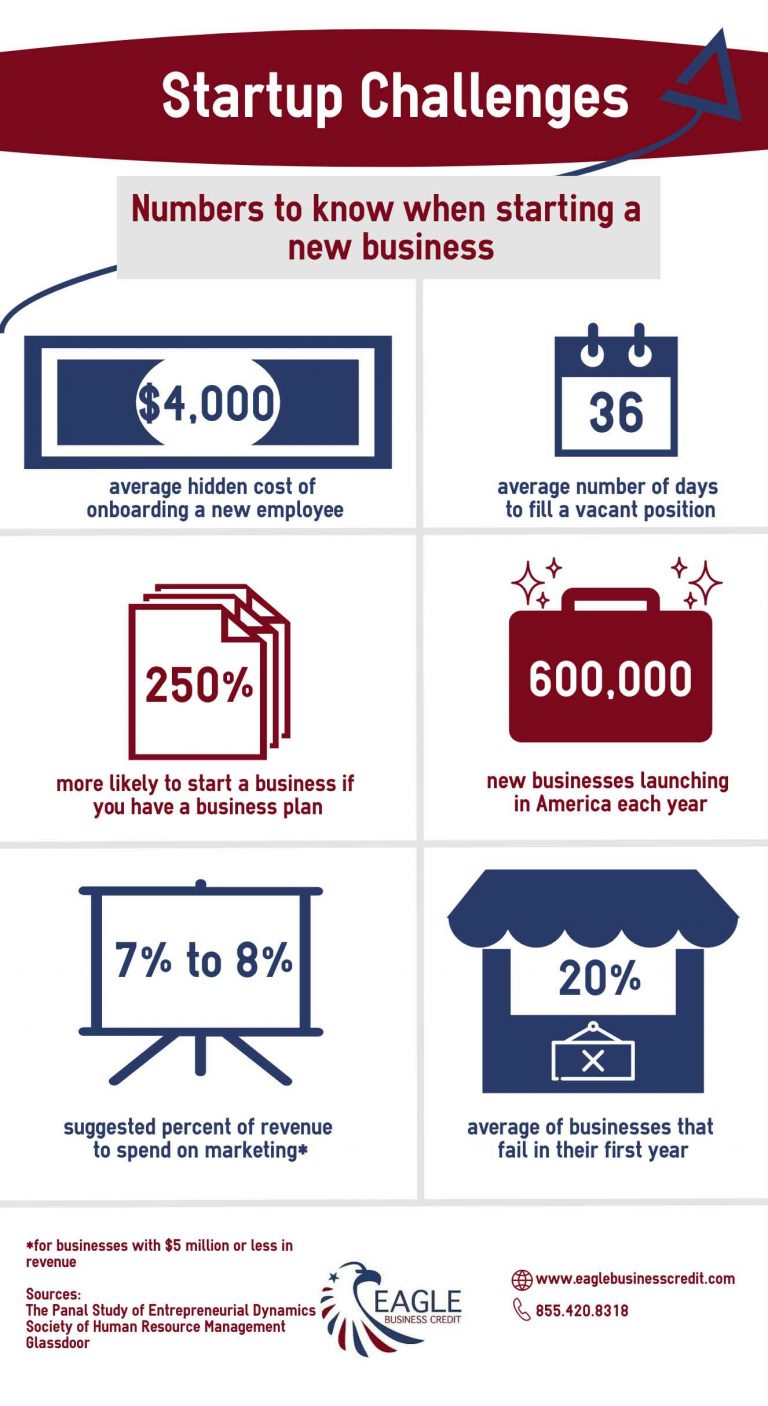

Launching a startup business comes with challenges. The United States sees over 600,000 new businesses launching each year. Of these businesses, a quarter will fail in their first year, and only half will make it to their fifth year. No one wants to pour their passion, time, and money into a business idea only for it to fail. Here are steps you can take to mitigate the startup challenges and make it to year five and beyond.

Create a Business Plan

A business plan may sound like a staple of the past when you hear about startup success stories like Google or Facebook that strike it big without one, but those companies are the exception not the rule. The Panal Study of Entrepreneurial Dynamics reflects that a business plan increases the chance that someone actually goes into business by 250%. Besides the motivation to follow that entrepreneurial dream, business plans increase the access your company has to funding, enables business growth, and keeps you on track to achieve your business goals.

Market

You may have the perfect product that fills the needs of many, but how will people find out about it? Here is where marketing can make or break your business. It can be expensive with most businesses spending between 2 and 5 percent of actual or projected gross revenues on marketing, but small businesses generating less than $5 million in revenues should spend 7 or 8 percent on marketing, lest you hit a brick wall. Be sure to create a marketing plan so your budget is not wasted.

Smart Cash Flow Management

Your business plan should include financial projections and evaluate your funding needs. 82% of failed businesses cited insufficient cash flow as a cause of their failure. Is your company going to generate enough available working capital to cover fixed costs and supplier costs? If you sell on credit terms, do you have enough capital to wait the 30 to 60 days it takes your customer to pay? Traditional lenders, like banks, can be wary to finance startups, but alternative lenders specialize in startup funding.

Retain Top Talent

The average time to fill a vacant position for a company is around 36 days according to the Society for Human Resource Management. This is a number to remember when planning for business growth or when hiring a new employee. Don’t wait too long to fill the open position in your business if you are expecting growth. Give yourself enough time to hire someone that fits with your company culture, shares your enthusiasm for the business, and has a complementary skill set to add to the team. Glassdoor reports the hidden costs of onboarding a new employee to be around $4,000. When hiring employees, it’s best to get it right the first time.

Eagle Business Credit is an invoice factoring company that works with startup businesses to finance their growth. Factoring does not require a lengthy time in business, high credit score, or personal guarantee to provide funding to your business. See how you can sell your receivables and grow your startup today.