You run your own business. You recognize the importance of working capital, and you want your financing strategies to improve your working capital management. You may have shopped around for working capital financing. Online loans, bank loans, MCA loans, and equity-based funding are all looking appealing, but what is a factoring loan?

Factoring Loan

Technically speaking, the phrase “factoring loan” is misleading. Invoice factoring is a working capital funding strategy that does not require debt or equity. Rather than being a loan, upfront money requiring repayment and interest, it is a purchase of debt.

What Is a Factoring Loan?

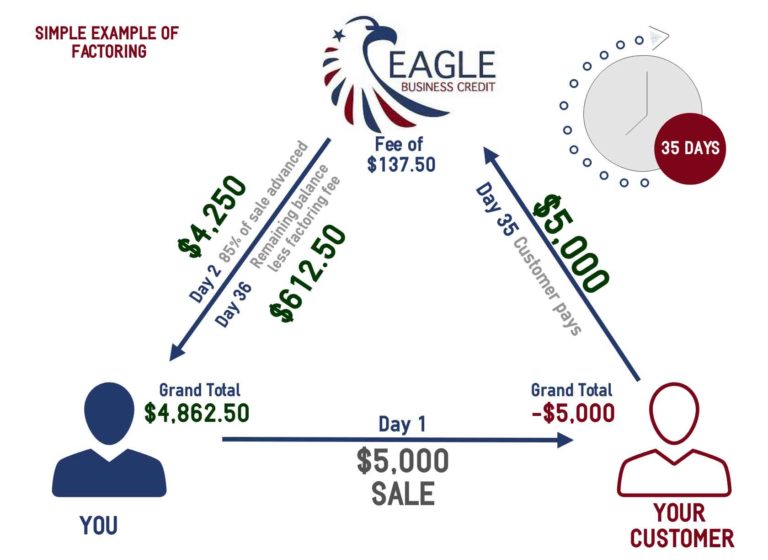

- Business makes a sale to Customer

- Factoring Company advances 80-95% of invoice amount to Business

- 30 to 60 to 90 days go by

- Factoring Company collects invoice amount from Customer

- Factoring Company gives the rest of the invoice amount (less a fee) to Business

The example above is a short representation of a factoring transaction. Rather than a debt to repay to a factoring company, a small business sells their open invoices at a discount to a factor and keeps making more sales with the improved cash flow.

Business Factoring Loans

Since invoice factoring is a working capital financing strategy that is debt-free and without interest rates, it is not considered a loan. Therefore, business factoring loans are simply referring to invoice factoring transactions to improve a small business’ cash flow. While strategies of financing working capital could include a business loan, business factoring loans simply refer to debt free small business financing that is just a sale of receivables.

Factoring Loan Companies

If you are searching for factoring loan companies it is probably because you are a growing business or cannot qualify for traditional bank loans due to business credit or time in business. Eagle Business Credit is a top rated factoring company offering “factoring loans” to small businesses in the USA. As a debt free method of working capital finance, invoice factoring is used in a working capital management strategy to help scale your business. Factoring facilities are based on the volume of sales, so the working capital funding grows with your needs. Curious about Eagle Business Credit’s financing strategies to help your company’s working capital management strategies? See how we can improve your company’s cash flow with our low fees and growing facilities.

How to get fast business funding with invoice factoring:

Invoice factoring is designed to be quick and painless for a small business owner. You sell your goods, and the factoring company gives you immediate payment. You don’t have to wait 30 to 60 days for your customer pays. Instead, you continue making sales and growing your business.

- Sell your goods to a customer

- Submit invoice for funding

- Receive funding same day

- We collect the invoice amount from your customer when payment is due

Additional services included for free along with your business funding include receivables management, credit monitoring, and an online dashboard available 24/7 for account access. Invoice factoring takes the pain out of running your own business by outsourcing the painful processes to a factoring company in Dunwoody, GA.