Are you ready for the uncertain road ahead?

Super Tuesday is over, so now what? It looks pretty certain who the candidates for the Republican and Democrat parties will be and the inevitable

Super Tuesday is over, so now what? It looks pretty certain who the candidates for the Republican and Democrat parties will be and the inevitable

Running a business often requires navigating the ebbs and flows of operational finances. To maintain smooth operations, access to working capital is essential, allowing businesses

Obtaining a working capital line of credit should be an essential step for small businesses seeking a steady, predicable flow of funds. As a functioning

A working capital line of credit serves as a vital tool for businesses to manage their day-to-day operational costs effectively. At Eagle Business Credit, we

Take the right steps to ensure your business never runs out of money. Managing cash flow is a critical aspect of running a successful business.

In the unpredictable world of small businesses, adopting a proactive approach to cash flow management is not just a smart strategy; it’s a survival necessity.

In recent times, the global economic landscape has been marked by unexpected shifts, and one such concern is the higher-than-expected inflation rate. As of the

In small business financing, the influence of interest rates is a critical factor shaping various funding options. It is important to understand specifically how interest

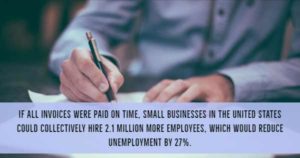

If you are running a small business, you’ve probably found yourself in a frustrating, but very common situation. You may find that your business is

It’s not difficult to send an invoice and collect a payment, which is why most companies start out doing that in-house. However, collecting on your

Companies are announcing layoffs, with the second largest ocean carrier in the world downsizing their headcount by 9% within the next year. Banks are also

If you operate a small business of any type, then you have probably at least heard of invoice factoring. While invoice factoring is an incredible

When it comes to starting and running a successful business, there are hundreds of important aspects that you need to be focusing on. Ensuring fast

Starting a small business can be an exciting venture filled with dreams of success and profitability. While many new entrepreneurs are keenly focused on generating

Many small business owners have been turning to accounting software for their bookkeeping needs. Software can be used with or without an accounting department, depending

615 Molly Lane, Suite 130

Woodstock, GA 30189

Toll Free – 855-420-8318

info@eaglebusinesscredit.com

Bob Wellenstein

Direct line: (414) 449-5645

bwellenstein@eaglebusinesscredit.com

Mike Pedersen

Direct line: (646) 437-0317

mpedersen@eaglebusinesscredit.com