There is increasing speculation of an impending recession due to the trade war between America and China, Federal Reserve rates lowering, and an inverted yield curve. But what does all this mean to the common small business owner, and what preparation can foresight provide entrepreneurs?

Is a Recession Coming?

In short, yes. A recession is coming, but we don’t know exactly when. A majority of business economists predict a recession starting by the end of 2021. The traditional recession indicators, like the yield curve for treasury bonds, manufacturing index, and the Federal Funds Rate are pointing to a likely recession soon. Bloomberg reports that markets are dictating the potential for recession being at the greatest since the Great Recession.

Small Business and Recession

The Federal Reserve Bank of New York shows a disproportionate decline in health for small businesses during the Great Recession than for larger firms. Estimates show that between the end of 2007 and early 2010, small business employment dropped 40% more than large businesses. Since the 2008 Recession, banks are more risk averse—meaning less capital is extended to small businesses. This affects over 82% of business owners that cite regional or large banks as their funding source. Cash flow for small business owners was hit hard with a drop from 65% of business owners reporting good cash flow in 2006 to just 30-40% of owners reporting good cash flow during the recession and recovery.

Recession Preparation

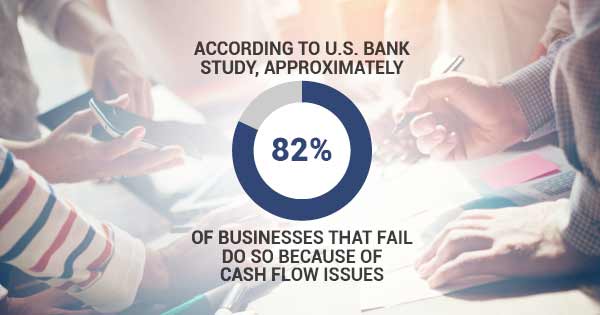

82% of failed businesses cite cash flow as the reason. The most important thing to do is boost your cash reserves and improve your cash flow. There are less community banks due to the consolidation of assets in larger banks. These larger banks are less and less likely to extend credit to small business owners due to the higher risk associated with small business success. Even though interest rates associated with banks loans are dropping, many entrepreneurs will be unable to secure enough funding to last through a recession. Take advantage of the low interest rates now, and plan ahead to future financing when banks extend less capital to small business owners.

Recession Financing

This is where a revolving line of credit on your receivables, like invoice factoring, can help weather a recession. Factoring is not tied to the Federal Funds Rate and doesn’t require any repayment. A business owner does not need to rely on debt for business funding. The amount of financing is reliant on your sales volume and grows with your business. Further, factoring services that include credit monitoring can save your business from doing business with customers that may not be able to pay for your goods or services.

See Also:

#TheMoneyFactor Episode: 010 – How do you recession-proof your business?