There are so many reasons why you need to improve your business cash flow. It takes money to make money, so you need to have cash on hand to afford supplier costs, labor costs, overhead, and marketing. When it comes to growing your business, you need even more money to afford taking on larger orders, new employees, and developing new products or markets.

How to Improve Your Business Cash Flow:

- Receivables Management Practices

- Offer Vendor Discounts for Early Payment

- Trim Your Unnecessary Costs

- Invoice Factoring Services

Managing Your Receivables to Improve Your Cash Flow

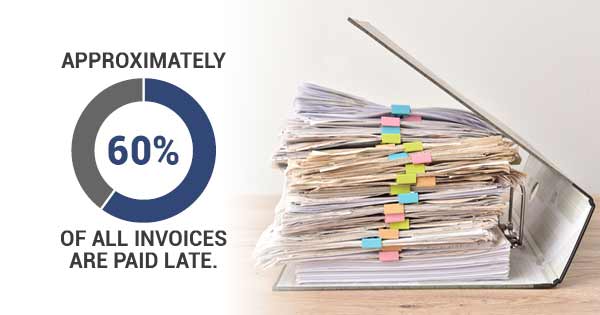

Managing your receivables can be a time intensive process but is so necessary to identifying and unlocking the capital tied up in your receivables. Sending out invoices, following up on invoices, and eventually collecting on invoices all take active time from business owners or treasury professionals to perform as well as the passive time that selling on credit terms requires. What this means is that your small business cash flow may be weaker than it could be due to the potential cash on hand being tied to your open invoices. Having shorter selling terms or implementing stricter invoicing practices can benefit your business by collecting customer payments faster.

Offering Vendor Discounts to Improve Cash Flow

Some business can afford to make vendor payments on time or early. This leaves an opportunity for business owners to offer discounts for early payments for their goods or services. Getting paid within 10 days rather than the standard net terms of 30 days can bring payments in faster and allow your business to grow with the available cash on hand.

Trimming Your Unnecessary Costs to Improve Your Cash Flow

Unnecessary costs in your business can stack the money going out taller than the money coming in. Your cash flow will reflect this and you may be harming your business opportunity as a result. Look at how you are engaging your employees. Is there more they could do? Could you break apart roles to specialist capacities to increase productivity? Do you need more or fewer employees? Cash flow and employee satisfaction go hand in hand. If you miss payroll, you will either lose valuable team members or demotivate them from contributing to your business. How about the technology you have for your business? Are you employing it to its max or is there more you could be doing with your investment? Maybe you aren’t using the tech stack you have and you can trim down on your monthly costs that way. Take a look into your recurring costs and see what areas are inflated and what areas may need more investment.

Invoice Factoring Services to Improve Your Cash Flow

Invoice factoring involves a factoring company purchasing a small business’ open invoices at a discount. Basically, your company makes a sales and gets payment immediately from the factoring company. Your customer then waits the allotted credit terms and pays directly to the factoring company. This service saves business owners time, effort, and money. Without the burden of lengthy invoicing processes ensuring you will be paid by your customer, you can focus on running your business and even growing your business. The factoring company can manage your receivables, offer credit checks on potential customers to mitigate the risk of customer non-payment, offer immediate working capital the same day as the business sale, and take the time and effort of the collections process off your shoulders. Invoice factoring services improve cash flow at a low cost.

Many other business financing options can get expensive with high APRs or frequent repayments that can actually hurt your cash flow in the long or short term. Invoice factoring is a business growth solution that enables small business owners to have the cash on hand or cash reserves to operate their businesses with growth in mind.