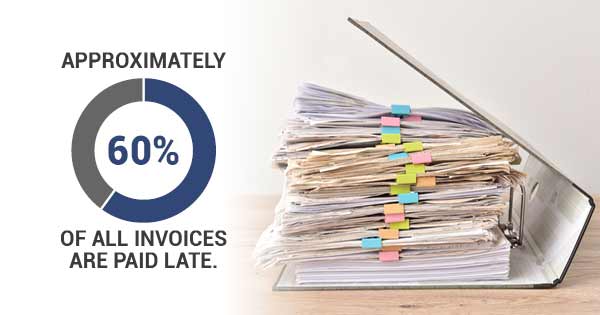

In an ideal world, you would collect payment for your goods or services immediately from your customer. Granting credit to your customer means you must wait before you have cash in your hand that you can use to make more sales. It also means that you can stay competitive. Other companies in your industry may offer credit terms to their customers, so it may be beneficial for you to do the same.

Do You Have to Grant Credit Terms to Your Customers?

No, you do not have to offer credit terms to your customers. However, it may be in your best interest to offer credit terms to your customers in order to stay competitive, consistent, and be able to grow. The hit that your cash flow will take can be offset with services like invoice factoring, and your ability to bring on new customers and keep those customers can be a huge driver in offering credit terms to your customers.

What Does Net 30 Mean?

If you sell to other businesses on credit terms, you have probably come across the term “Net 30.” All this means is that the payee has 30 calendar days to pay the invoice after the billing date. So, once you are billed by the seller, you have 30 days to pay. Paying later than 30 days could incur late fees, and paying earlier than 30 days could grant you a discount. Many sellers offer discounts for early payments on net 30 invoices.

Net 30 From What?

Net 30 payment terms can start on the day you receive the invoice, the day you receive your shipment or service, or the day the sale is finalized. It depends on the specific agreement you have made with the seller. If you are the seller, then you should include the start date of the net 30 payment terms somewhere in your invoice and in the sale agreement. Make sure your buyer understands when they need to pay you.

What Is 2/10 Net 30?

2/10 Net 30 terms mean that the buyer can have a 2% discount for paying within 10 days. It is a common early pay discount that sellers offer to incentivize their customers to pay sooner. 2/10 and 3/10 discounts exist because the seller wants better cash flow. There are other methods of improving your cash flow, but this is a common one that can benefit both the buyer and seller.

Can You Afford to Offer Credit Terms to Your Customers?

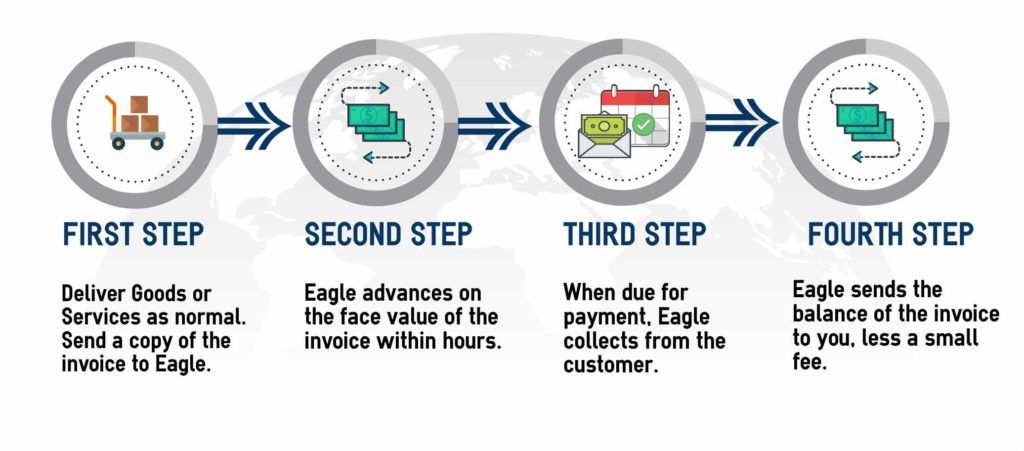

So the big question you have to ask yourself is whether you can afford the cash flow strain that credit terms will cause on your business. Offering early pay discounts can help improve your cash flow, but it relies on your customers being able to pay early. Invoice factoring is a funding solution that offers immediate payment on your open invoices. This means you can extend credit terms with your customers and not have strained cash flow. Eagle Business Credit is a factoring company that pays your business the same day you issue an invoice. You customers can still pay on net 30 terms, but we pay your business instantly.

How Factoring Works: