Start-ups are a hot topic these days, with many small players having rocketed to the top of the marketplace in the past couple of decades. Not all businesses get off the ground. If cash flow doesn’t stop your new business dreams, then lack of planning will. Take the time to prepare a business plan and be sure to have your ducks in a row from financing to marketing with hiring the right people in between. Here are the foundation elements you need to turn a good idea into a viable business.

Things You Need to Start a New Business:

- A Business Plan

- Market Research

- An Adaptable Pricing Model

- A Strong Team

- Marketing and Branding

- A Plan for Growth

- Financing

In short, these are the things you need to start a new business. All of these should be covered in your business plan. Planning your business requires a viable plan for growth, building your team, building your brand, and actually making sales. All of this is possible through your exploratory phase. This involves researching the market and your target audience. Is there a need you are fulfilling? What sets you apart from competition? Does your initial pricing make sense? Will your pricing model be sustainable as your overhead costs grow? Will you have a strong team to join your business when you are growing?

Leaving all the work to yourself will stretch you too thin and hinder your growth. Delegating is an important part of leadership. Will your brand be recognizable? Branding and marketing does not have to be expensive. Authentic messaging that speaks directly to your target market can be accomplished with low monetary costs, but it will require time and effort. Building a brand starts with a strong product and service that resonates with your audience. Finally, a growing business requires more money to sustain growth. Often, open invoices can slow your business growth. Develop a financing plan that accounts for this cash flow gap. Flexible financing options like a line of credit or invoice factoring offer financing on your terms as you need it.

Foundation Elements of Starting a Business

- Business Planning

- Building the Right Team

- Branding and Online Presence

- Funding and Starter Capital

Start-Up Business Plan

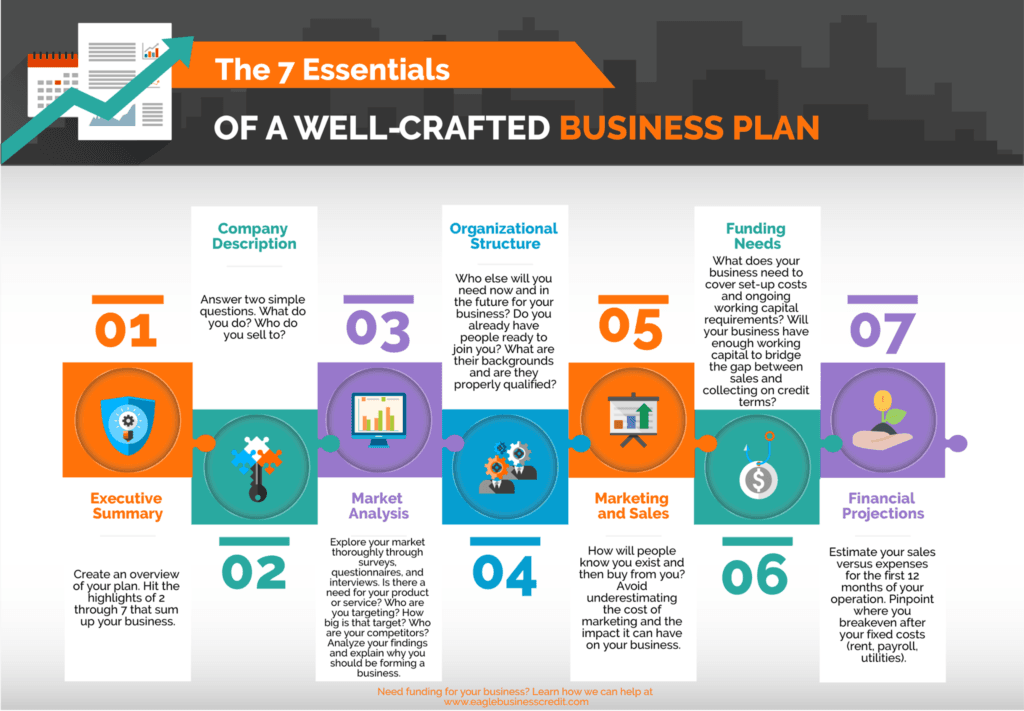

A business plan is key place to start when developing your company. This plan should cover what problem you’re trying to solve, who your target clients or customers are, how you’re allocating resources, and what your goals are for the future. Key performance indicators are signs that your business is moving in the right direction or that specific plans of action, like marketing strategies, are working in your favor. These should be part and parcel with your business plan.

Business planning structures your growth. 82% of failed businesses cite lack of capital as a cause for failure. Growing businesses require more money to cover overhead. A plan helps with reevaluating the budget, forecasting future financing needs, and pivoting strategy for business growth.

Employees and Growing Businesses

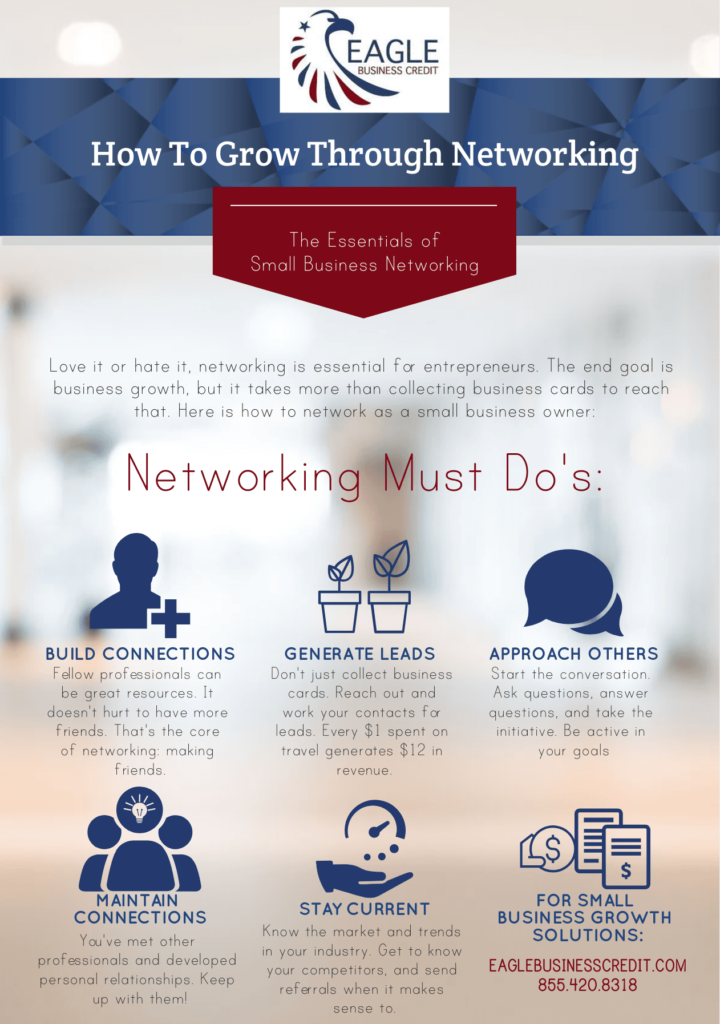

Committed team members are essential to starting a business. No businesses are individual ventures in a bubble. Networking and finding skilled partners is a must.

Small businesses can attract top talent by offering benefits that larger companies can’t compete with. Access to senior leadership, growth potential, and a feeling of ownership over the business are all benefits that small businesses can offer employees. Building a team that grows with your business and your business culture is important.

Branding and Online Presence for Start-Up Businesses

Building your brand and creating an online presence are mandatory components of the business world today. Branding elements should be present in your business plan and work to help customers understand what your company stands for. Remember the target market you want to reach and speak directly to your specific audience. Lastly, don’t purchase likes for your social media. Earn engagement from your audience by putting in the time and effort to meet their needs. Authenticity is key here and there is no way to game the system. Let your business speak for itself, and don’t be afraid to showcase the people behind the business!

Funding and Starter Capital

Funding and starter capital makes everything happen. Without investors or funding to get off the ground, even the best business ideas won’t ignite. Like the adage says, you need money to make money.

Venture capitalism is the first thought for start-up business owners, but are you willing to trade equity for funding? Many business owners run into challenges finding starter capital due to not having enough time in business to secure a loan. Alternative financing options offer start-up financing with less approval requirements than bank loans.

Small Business Growth Solutions

At Eagle Business Credit, we’re committed to giving driven entrepreneurs the fuel they need to get their businesses off the ground and into the marketplace. We provide financing services like invoice factoring for businesses that need capital even during the process of acquiring and billing customers. If you’re looking to find a way to fund your dream, we have helped numerous company owners do just that. Take a look at our accounts receivable funding services to find out more

Do you have what you need to start a new business?

Business planning will be the most important part of starting a new business. Make sure to price your goods or services appropriately and account for growth with hiring new employees. Marketing and creating an online presence will pay off over time. In the short term, don’t be afraid to ask for referrals and reach out to your established network. Go to networking events and try to carve out a space in the market for your business. Most importantly, don’t run out of cash. If you need financing but haven’t been in business long enough to qualify for a small business loan, invoice factoring is an option. Eagle’s factoring services are built for new or growing businesses looking to improve their cash flow and make more sales.