Funding Your Business

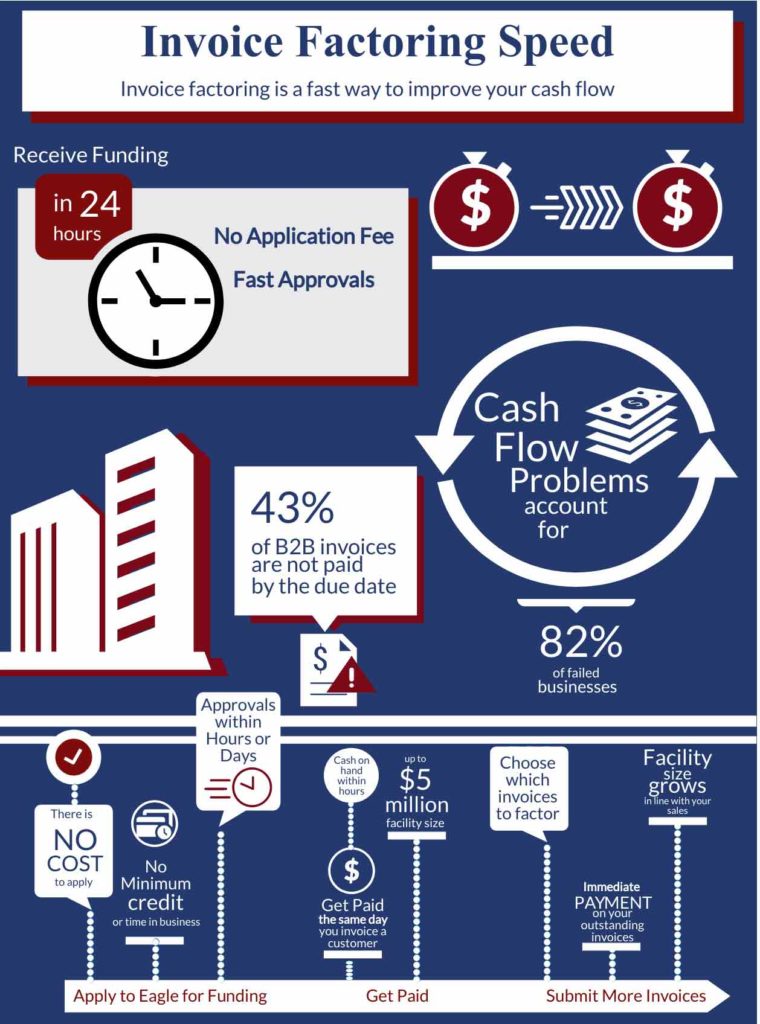

The boot-strap method of financing your business—tapping into your savings, retirement, or refinancing your mortgage for all the available capital possible—can be enough to get your business off the ground, but then what? Growing businesses require more funding, and when 82% of failed businesses cite cash flow problems as a cause, it is smarter to find a funding source sooner rather than later. Here are some debt-based small business financing options.

Conceding control of your business is daunting to any proud entrepreneur. There are horror stories of founders being pushed out of their companies through legal processes , online lenders employing predatory practices that strip entrepreneurs of business and personal finances, and simply not having enough working capital to stay in business. This makes finding funding for your business a complex process that requires time, attention, and research. Often entrepreneurs find themselves in a cash flow crunch and short on time to get the funding they need, stuck between debt and equity-based financing options.

Debt Financing

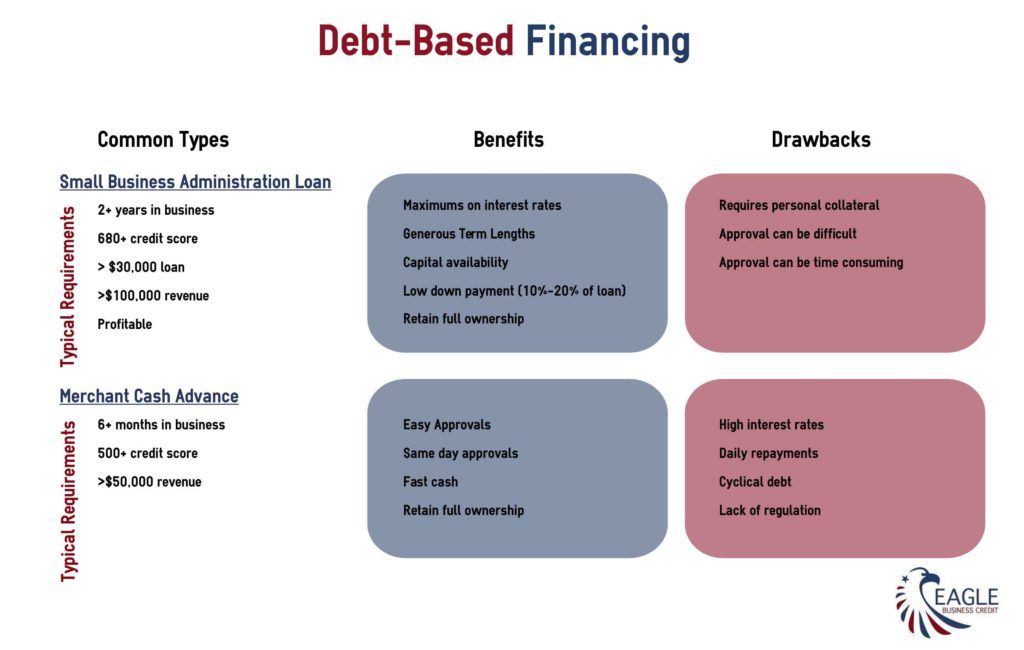

Often, businesses turn to debt-based financing when they are concerned about sharing ownership of the business they created. Equity-based financing often comes with conceding some control and decisions to one or more investors. There are several types of debt-based financing that might be a solid working capital funding strategy for your business if you have the time to wait for approval or projected revenue to cover the interest rates.

Small Business Loan Debt

The average time for an approval of a Small Business Loan from the SBA is between 60 and 90 days. So, while it typically offers the best repayment rates and terms, an SBA loan can’t provide the fast funding needed for growing startup businesses. Still, SBA loans are a great option for debt-based small business financing.

Merchant Cash Advance Debt

Merchant Cash Advance companies can fund businesses in a week or less, presenting themselves as an appealing option. MCAs may look good to businesses that need money quickly, but this funding option is typically the most expensive option. No only is it expensive for small businesses at 40-400% APRs but repayments will be daily or weekly. Cash flow would most likely be damaged.

What is Invoice Factoring?

If you are concerned about sharing ownership of your business, consider accounts receivable funding as your business finance strategy. Eagle Business Credit offers fast financing with transparent fees at the lowest cost possible. When you make a sale, you sell your receivables to Eagle Business Credit at a discount. Then, we provide your business immediate payment for your open invoice, and we wait the 30 to 90-day credit terms to collect payment from your customer.

The amount of funding available to your business depends on the volume of your sales. So, your funding strategy grows with your business. Financing receivables does not require a lengthy time in business or high credit score. We specialize in funding startups and first-time entrepreneurs. You started your business; you get to run it the way you want.